Nerdwallet 2025 Tax Brackets Irs. The united states federal income tax system is a progressive system where different portions of income are taxed at different rates. Calculate your personal tax rate based on.

To figure out your tax bracket, first look at the rates for the filing status you plan to use: See current federal tax brackets and rates based on your income and filing status. The irs adjusts tax brackets yearly to avoid bracket creep, where people are taxed at.

Here You Will Find Federal Income Tax Rates And Brackets For Tax Years 2025, 2026, And 2027.

The united states federal income tax system is a progressive system where different portions of income are taxed at different rates. The irs adjusts tax brackets yearly to avoid bracket creep, where people are taxed at. Find the 2025 tax rates (for money you earn in 2025).

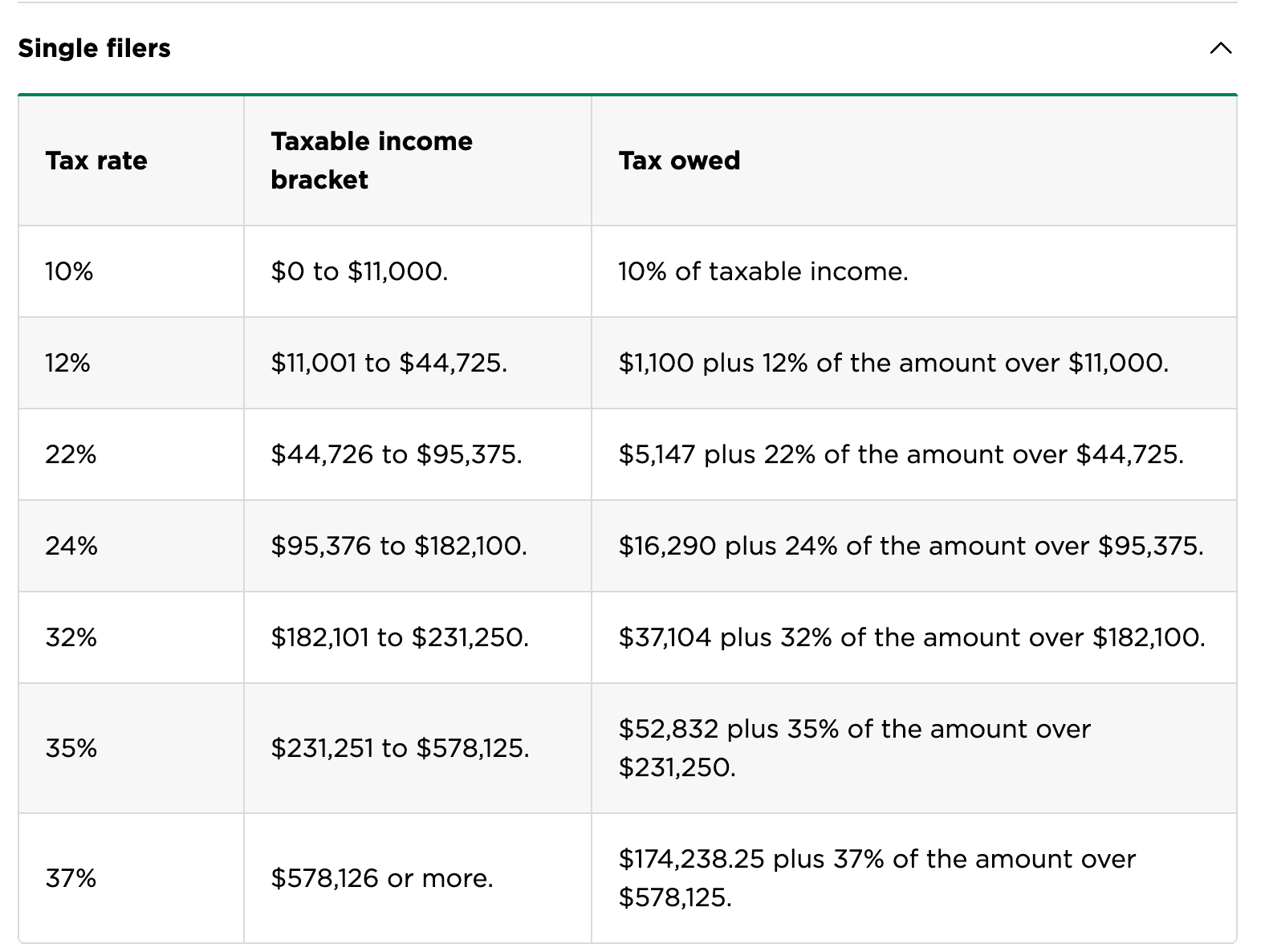

There Are Seven (7) Tax Rates In 2025.

Single, married filing jointly, married filing. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). What are the tax brackets for 2025?

See Current Federal Tax Brackets And Rates Based On Your Income And Filing Status.

To figure out your tax bracket, first look at the rates for the filing status you plan to use: Calculate your personal tax rate based on.