2025 Tax Brackets Mfj Income Limits. Let’s see how much tax one has to pay with or without marginal relief on incomes of ₹12.1 lakh, ₹12.5 lakh, and ₹12.7 lakh, according to cbdt. Under the old tax regime, income up to ₹2.5 lakh is exempt, with rates progressing to 30% for income above ₹10 lakh.

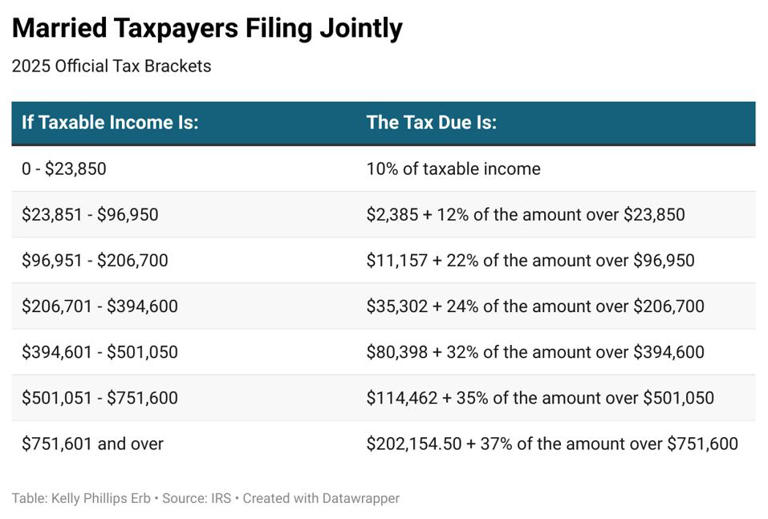

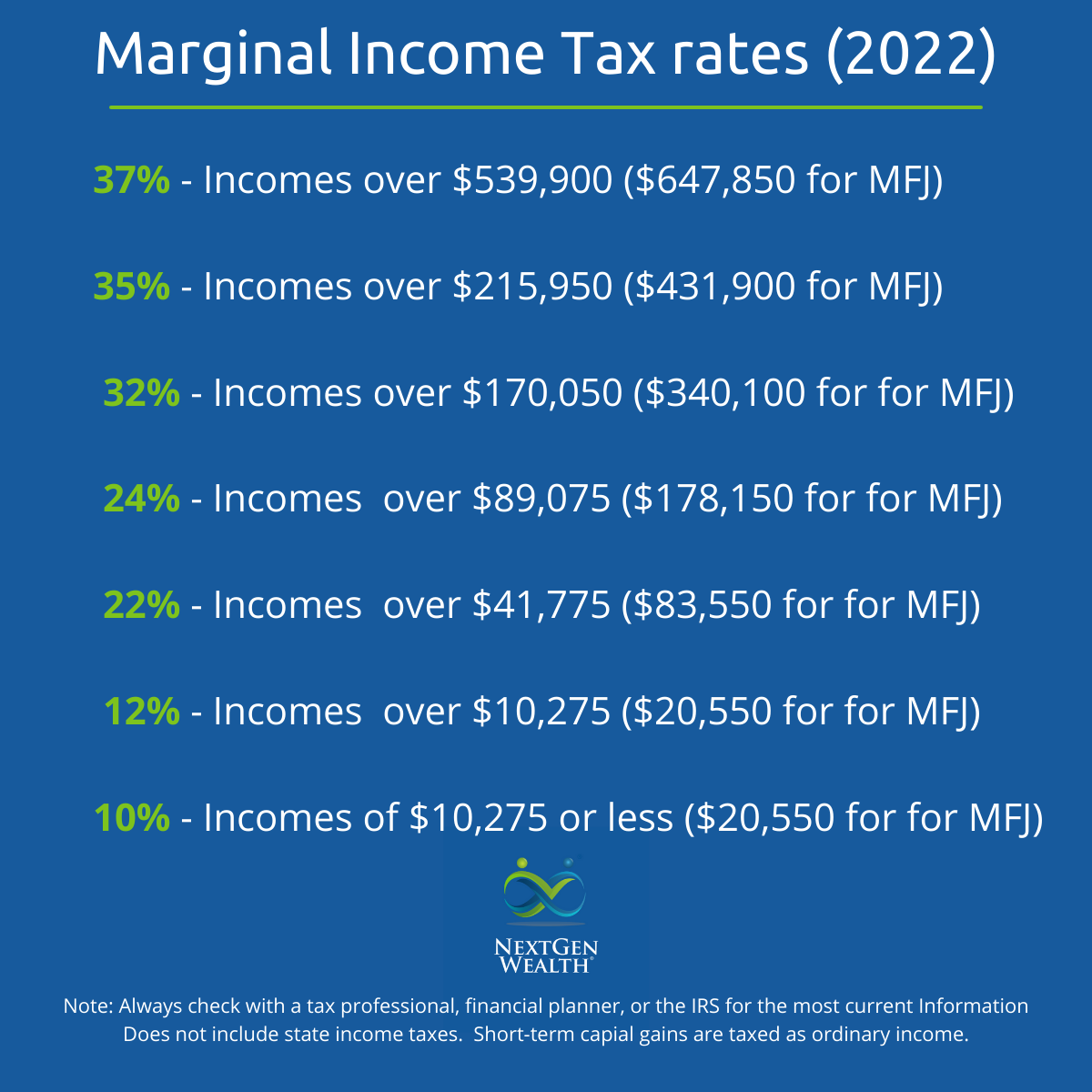

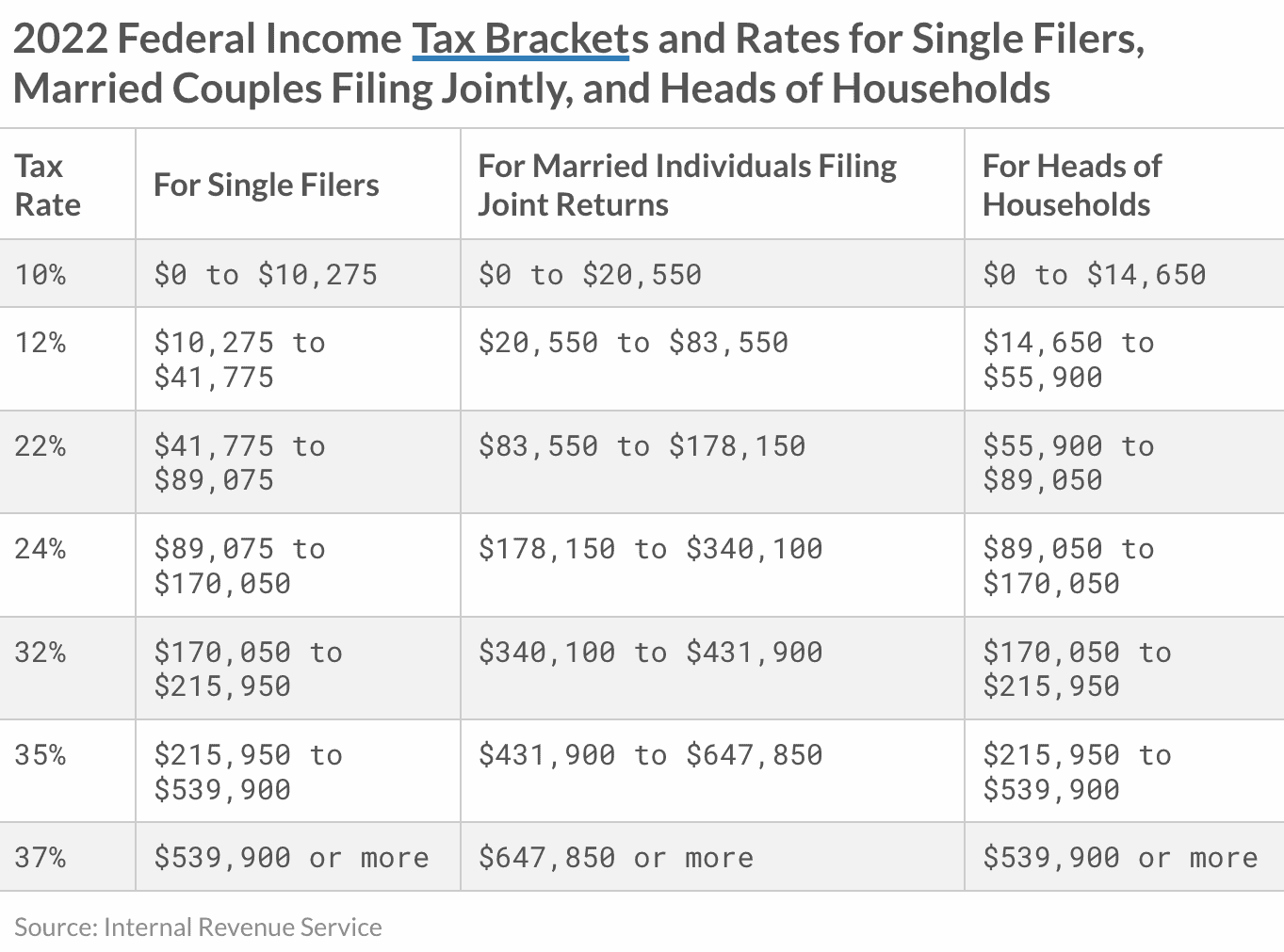

Beyond this limit, the relief ceases to apply, and taxpayers. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for. The 2025 tax brackets for mfj filers will likely follow a tiered structure, similar to previous years, with progressively higher tax rates applied to.

Beyond This Limit, The Relief Ceases To Apply, And Taxpayers.

Let’s see how much tax one has to pay with or without marginal relief on incomes of ₹12.1 lakh, ₹12.5 lakh, and ₹12.7 lakh, according to cbdt. Understand the difference between the new and old tax regimes. Marginal relief is applicable up to an income of approximately rs.12,75,000.

Under The Old Tax Regime, Income Up To ₹2.5 Lakh Is Exempt, With Rates Progressing To 30% For Income Above ₹10 Lakh.

With marginal relief, a taxpayer will not have to pay full tax when his/her income is just a little over ₹12 lakh. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for. The 2025 tax brackets for mfj filers will likely follow a tiered structure, similar to previous years, with progressively higher tax rates applied to.